Bookkeepers, like us, usually leave filing and compliance tasks to your business’ tax accountant. But 1099s are one of the things you can do yourself for your small business that save you money.

We recommend Track1099 software as the best do-it-yourself option. It’s easy-to-use with a low per-form fee. If you use any of the online versions of QuickBooks, they include a feature that allows you to file your own 1099s, as well.

What is a 1099?

If you need a 101-type refresher on 1099s, I’m glad you’re here.

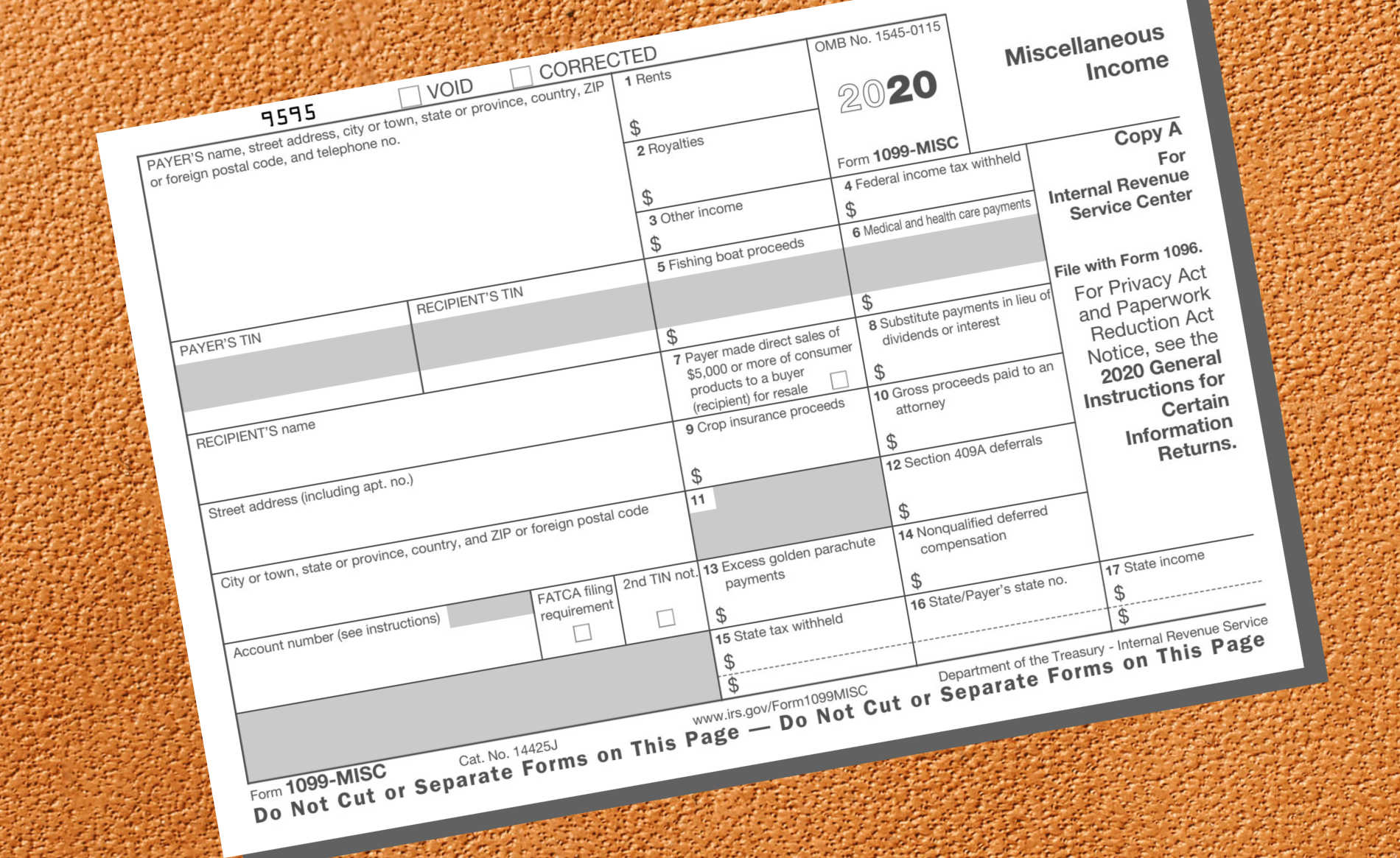

First off, who gets a 1099-MISC form? Any unincorporated business or individual (other than employees) to whom you paid more than $600 during the year for services or rent, or more than $10 during the year for royalties. (Note: While there are other boxes on the 1099, I bet you won’t need to bother with the form unless you pay out crop insurance or fishing boat proceeds. If you aren’t sure if you need to file amounts in any of the other boxes, ask your CPA.)

If you used a credit card, PayPal or third-party processor, you do not need to include those amounts in the 1099.

Rarely is it wrong to send a 1099. However, if it’s not needed, why not save yourself some hassle! Your accountant should know your needs for sure.

What is a 1099 used for?

Think of 1099s as your way of letting your vendors know what your business is reporting to the IRS. Unlike a W-2 form, a 1099 does not have to match the vendor records exactly. For instance, if you paid by check in December but a company doesn’t cash it until January, you would show the amount on last year’s 1099 form — but they would show it as income this year.

1099s and incorporated businesses

Certain businesses don’t need a 1099, including corporations. How do you know if someone is incorporated? Well, you would have to get a W-9 form to know for certain. (It’s available for free from the IRS.) You could also ask for a W-9 before you issue payment to any vendor unless they have “Inc.” in their name. Only by having the W-9 are you covered in case the tax ID comes back as incorrect or as proof that you didn’t need to issue a 1099. (Note: The IRS lists 1099 exceptions here.)

The 101 on 1099s

Does this brief 1099 overview feel overwhelming?

If so, schedule a call with us and we can walk you through the steps — and we can answer any questions you might have about our “breathe-easy” bookkeeping services, too.