Hey, you! You there, with the small business! Are you filing federal income taxes monthly or quarterly? And are you sure you’re choosing the right option?

If a chill just went down your spine, you’re not alone. Paying small business taxes is intimidating enough without doing it four times a year, and it’s easy to just assume that taking the easy route — filing once per year — is good enough. And it might be…but then, it might not. There are several variables that affect how often you should be paying taxes to the federal government.

Why not let this year be the year you stop panicking about filing taxes? Here’s how to avoid the tricks of timing tax filings for your small business and maximize the treats (as in, avoiding penalties). Today we’ll break down the difference between lump sum and estimated tax payments, who files what when, and whether you should be filing your small business taxes monthly or quarterly.

Filing a return, paying taxes — what’s the difference?

Filing your tax return and paying your taxes as a small business are the same thing, right? Not necessarily. Depending on how much you owe in taxes, you might be paying once per year or once per quarter, but no matter what, you’ll still need to file a yearly return.

(If you’re a sole proprietor or single-member LLC, you’ll be filing that yearly return on a Schedule C along with your personal tax returns by April 15. Other business structures may vary on due dates.)

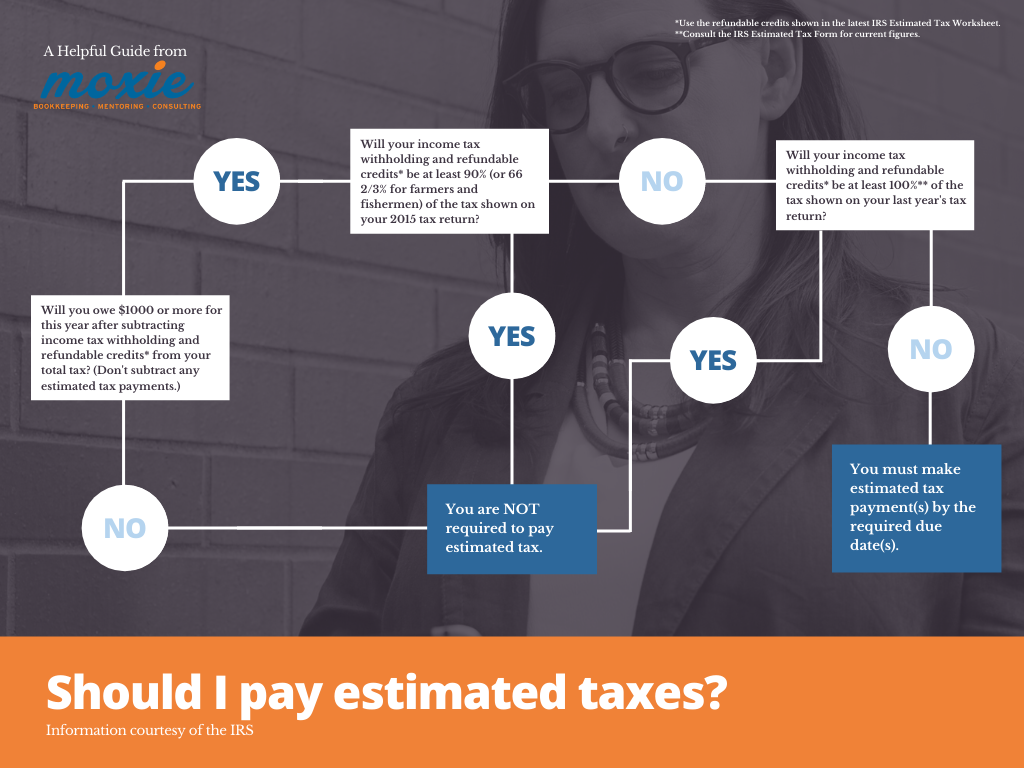

The surefire way to tell whether you should pay yearly or quarterly

There are two pieces of information that will tell you whether you should pay your small business taxes yearly or quarterly: who you are and your expected tax total. If you meet both of these conditions, you’ll pay quarterly.

Who: If your business is structured as a:

- Freelancer

- Independent contractor

- Partnership

- Part-time business (yes, these count too!)

Then you should pay quarterly. The reason is that you’re essentially compensating for the Social Security and Medicare paycheck withholding that your employer would be taking care of if you were holding down a salaried job.

What: You expect to pay $1,000 or more in business taxes this year.

If you do not meet both conditions, you can continue to pay yearly until you do. (Go get that business growth! Profit-first accounting can help you reach the threshold of success that means filing quarterly; check out our friendly guide to making the switch to profit first.)

It’s time to pull out your crystal ball

If you’re looking at paying quarterly taxes, the IRS expects you to perform a bit of magic and look into the future. Rather than paying the taxes from last quarter’s income, you’ll be estimating your future income. That’s because you’re making up for those taxes that aren’t being withheld by an employer, as we talked about above — and the IRS doesn’t want to wait a year for those payments.You’ll need to figure out your estimated gross income and then use this worksheet to figure out your estimated taxes. It might help you breathe a little easier to know that you don’t have to perfectly predict the future, since this process can be very tricky for brand-new business owners. Use your previous year’s income (if any), any forecasts or projections you have on hand for your business growth, and try your best. It’s better to overestimate (and get a return) than underestimate (and risk financial penalties for underpayment).

When should I file my small business’ quarterly taxes?

The IRS’ filing dates are the same every year (with the exception of emergency conditions like 2020’s pandemic filing date changes), so put these dates in your calendar on a recurring basis and set up any reminders you might need to ensure you meet each filing deadline.

| Period | Date to File |

| January 1 – March 31 | April 15 |

| April 1 – May 31 | June 15 |

| June 1 – August 31 | September 15 |

| September 1 – December 31 | January 15 (of next year) |

How do I file my quarterly taxes?

Each quarter, use IRS Form 1040-ES to estimate the quarterly taxes you owe. This also gives you a chance to make adjustments if you underpaid or overpaid the previous quarter. That form contains some blank vouchers you can use to physically mail in your payment, or you can put down that crystal ball, pick up a keyboard and file electronically.

Looking for some last-minute tax prep advice? Here’s the IRS Self-Employed Individuals Tax Center. Also, check out these four quick tips or find the right tax preparer.

Got a scary situation on your hands?

I’m not afraid of tricky accounting. Schedule a complimentary call with me and we’ll discuss how to turn those tricks into treats.