Are you one of those small business owners who has been so focused on the day-to-day that getting ready to send out 1099s completely fell off your radar? You hardly realized that the year is almost over and now you are in a bit of a scramble trying to get all those year-end tasks in order?

You’re aware that one of those tasks is to send out 1099s to all of your contractors, right?

It is.

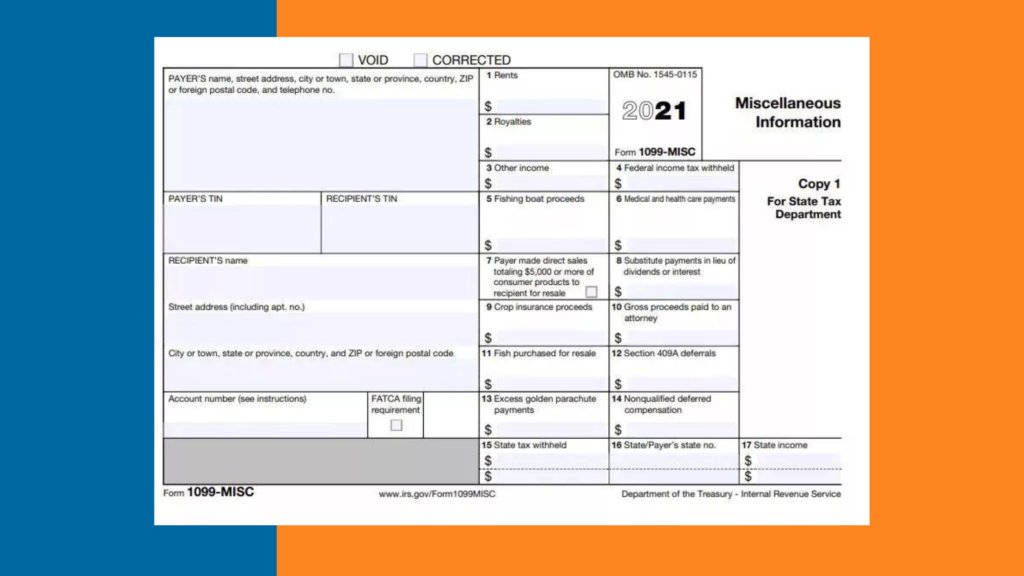

Before I go any further, though, we should probably make sure we are all on the same page. If you don’t even know what a 1099 is, you should probably check out our post about what is a 1099, and then come back when you’re done.

If you do know what a 1099 is, then, awesome — we’re simpatico and can proceed accordingly.

So how do you know if you are ready to send out 1099s to your contractors?

STEP ONE: who did you pay?

Well, first off, you need to know who were all the contractors you worked with over the course of the year.

The first thing you need to consider is which US-based folks have you paid over $600 in the last calendar year (overseas VAs, for example, don’t count)?

- That gentleman you had design a new logo?

- That lady you had do a week-long workshop with your team?

- Someone update your website?

- Someone do construction on your office?

All those fine folks you hired for specific jobs for a specified time frame? You know, the ones that you had fill out a W9 (see below if you, ahem, didn’t).

All those fine folks were people you contracted — they are the contractors.

You need to make sure you have a W9 for all those people.

If you do, then you have completed step one of getting ready to send out 1099s. Congratulations!

If not, you really, really need to do that as soon as possible. A matter of fact, you should just stop reading here and get that done. NOW.

Once you have all your contractors’ W9s, here’s what you will know about them:

- Their name

- Their business name

- Their tax classification (sole proprietorship, C corp, S corp, etc…)

- Any exemptions they may have

- Their address

- Their Taxpayer Identification Number

- Their citizenship status

All this information will help you when it comes to issuing 1099s, so aren’t you glad you already have it all in one place?

Yes. Yes, you are glad. Trust me.

STEP TWO: what did you pay your contractors last year?

Step two of getting ready to send out 1099s to your contractors is you’ve got to know how you spent your money. In particular, how much you have spent on your contractors.

And for that? You need clean books.

What does ‘clean books’ mean, you might ask (since you’ve never deployed Mr. Clean at your accounting spreadsheet or software)?

- Your books are up to date — all transactions have been imported/entered (if you are still using a paper ledger, I really do suggest that you consider updating — it might be hip, but it ain’t cool for whoever has to keep track of your accounts)

- You don’t have any uncategorized expenses or income remaining as there may be contractors hiding in the expenses — they haven’t been sneaky, you’ve just been a little unorganized (it happens, we understand, no judgment here). They still need 1099s, so make sure you recategorize them.

- Accounts are reconciled (the balances at the beginning and end of each month match those of the month-end statements for each account)

If the above list is adding a layer of stress to your seemingly endless pile of worries because you’re way behind on your books, you might want to check out this post about worrying less about bookkeeping stress from the past — we’ve got suggestions to help you out!

STEP THREE: Run an Expenses by Vendor Report

The approach is also great for owners of established businesses who want to tighten up financial practices and

Once your books are clean and up to date, you’re going to want to run an Expenses by Vendor report. This way you’ll know how much you paid everyone, which you’ll totally need in order to do 1099s.

If Expenses by Vendor sounds like more than you bargained for, run your Profit And Loss report (or pull up the spreadsheet), and click through to the detail report for your Contractors expenses account. Once you have those transactions, you can sort them by name of the Payee.

If this proves frustrating because there are a heap of detail-lacking Venmo or other mysterious payments, it’s time to add the following to your project list for next year: put some new vendor payment systems in place!

STEP FOUR: Decide who is doing your 1099s

One of the final decisions you need to make in the process is deciding who is going to be doing your 1099s. Is it you? Is it your accountant? Is it your bookkeeper, or do you need a contractor to get this done for you?

If you’re confused about the difference between what an accountant does and what a bookkeeper does, we got you!

A thrifty time saver if you’re doing your own 1099s

If you are a die-hard DIYer, our most highly recommended resource is https://www.track1099.com/. It’s a secure service, eliminates a ton of emailing with contractors, and will make your life so much easier. They also price per 1099 form-filed so no additional pesky monthly SAAS fee to impact your bottom line.

Here are some other reasons why they’re awesome (and no, that’s not an affiliate link above — we just want to help you help yourself):

- It syncs with your accounting software

- It saves a copy of the 1099 for as long as you need to save it

- It emails a copy to the contractor whenever you need to do that

- There’s even an add-on service that collects W9s for you (how easy is that?)

What’s not to love?

And there we go. Once you’ve got everything in order, all your ducks in a row (as it were), and you know who’s doing what, you are ready to start sending out those 1099s!

Mazel Tov, godspeed, good luck! And let us know if you have any questions in the comments!