Aka – Using the Profit First Cash Management Method To Plan For New Hires

Just that question ‘how much can I affordGrowth doesn’t have to be stressful if you have a system.

Growing your business is likely always going to feel a little scary and exciting – and that is a good sign. It means you are reaching beyond your comfort zone and doing new things. However, hiring the wrong person or not having a clear job description can be very costly.

The U.S. Department of Labor estimates the average cost of a bad hiring decision is at least 30 percent of the first year wages. If an employee has an annual salary of $50,000, the cost to the organization for a bad hire would be $15,000. In our experience, we’d say the costs are much greater if you factor in the drain on resources and morale.

How Do You Know How Much You Can Afford to Pay Your First Hire?

While hiring is as much art as science, and there are best practices to minimize the likelihood of hiring the wrong person, there is no magic fix. But, the good news is with a simple system, a little planning, and some help from our professional network, we can take the guesswork out of hiring and get the help we need to get to the next level.

Whether you are hiring your first person or your fiftieth, the question of how much you can afford to pay always looms at large. How can we get the quality of help we need without skipping our own paycheck or hurting instead of helping our bottom line?

Small business owner Amy T. sums it up well:

“Hiring will allow me to do and sell more. I mean, there are only so many hours in the day! Yes, I worry if I can afford it but, if I am able to charge more and be able to do more, I think I should be ok.”

As with many business owners in a growth phase, she is willing to pay herself less to make sure that she can afford her new hire.

But, there is a reason that all the good advice out there screams “Pay yourself first”!

You are your most valuable employee.

If you are paying yourself a fair and sustainable salary, your pay should naturally increase as your sales increase. It is normal that the percentage of sales that goes to your own pay should go down as you delegate more, but ideally, the actual dollars you get shouldn’t decrease since your productivity will increase – otherwise, what is the point of hiring?

Most businesses don’t have any system for attracting, recruiting, hiring, onboarding, or retaining staff. They know they need some help and they guess how much more income they could generate if they hired, and then negotiate wages based on how much they think they are able to pay.

They accept the first warm body that seems like they can do the work without having clear expectations and metrics of how this new hire will help grow the business.

To me, this is a recipe for disaster.

Amy’s approach of making her best guess and being willing to take home less is a great example of how most businesses hire. It requires a lot of guesswork and might be based on untested assumptions that new clients will appear without any plan to attract or support the new business needed to support the cost of the new hire.

Should You Hire A Contractor Or Employee?

Some businesses try to get around these additional costs of employees by hiring people as independent contractors, but that isn’t always legal. You don’t get to decide for yourself what the relationship is – the IRS has very specific guidelines that must be met for someone to qualify to be a contractor.

It has to do with who is in control of the “process” of the work. If, for example, you are hiring someone to design your website, likely they will come with their own way of doing things, their own tools and skills, and they are responsible for delivering a quality outcome. If their final outcome isn’t what was agreed upon, they don’t get paid.

Most contractors will probably work with several other clients and have their own business structure. Which would be a good example of a contractor relationship. You are interested in a good result and don’t have too much input on how to achieve it. If, however, you hire someone to assist you for the day helping with various tasks that you give them, that is more likely than not going to be an employee.

Many business owners worry too much about an IRS audit but few consider the far more likely scenario of a Department of Labor audit. Trying to save a little bit of money can become very costly if you mis-classify your employees as contractors.

So, the best approach is to make sure that you can afford the help that you need, and get the correct hire for you.

How Do You Make Sure Your Business Hires ‘Correctly’?

Having a clear job description, clear expectations of what you want to accomplish, and how you will measure success are all crucial elements of a good working relationship. Remember that onboarding is a part of building trust and communication so don’t rush that step. Make sure new hires are given enough time to get up to speed which can often take two to six months.

It is important to know that while compensation is an important part of finding the right hire, company culture, and the way you treat your employees outweighs getting the compensation exactly right.

When you hire an employee, you also need to remember that there are additional costs associated with wages, such as:

- Payroll processing

- Worker compensation insurance

- Disability insurance

- Payroll taxes

How much extra tax depends on the state, but generally 15%-20% is a safe roundup. Meaning, for every dollar you pay your employee, you should be ready to spend an additional $.15 to $.20 cents in ancillary costs.

We’ll talk more about how to work through these calculations in a future blog post. But for now…

How Do You Handle The Extra Expense?

I have a simple trick I know and use to make sure you aren’t taking on more expense obligations than your business can sustainably handle:

- decide what you would like to pay someone to help you with your current client load

- then set aside that amount in a business savings account on the same schedule that you would use for your payroll

- after a month or two of setting this money aside, you will absolutely know if you can afford that extra expense.

We work with clients who even set aside up to 6 months of new hire-related expenses so they can go through the growing pains of training that new hire with the confidence that they have the cash to make it all easy.

New income will only make it more affordable. This is a no-risk way to test out your educated guess without leaving you short for your current obligations. Now you have a cushion built up in case your first hire doesn’t work out.

How do you know when you are ready to start saving for a new hire?

Let’s assume you have one bank account tied to your regular operating expenses plus payroll. If you find month over month that cash is accumulating int hat account beyond your general expenses, that certainly tells you that you are ready.

That’s a sign that you’re ready to open that separate New Hire savings account and begin saving in earnest for the arrival of new expert help.

These techniques – of looking at your operating account balance, of opening a separate savings account and preparing for your new hire in cash – are both directly taken from the cash management system we use and teach to others: Profit First.

Let’s talk a bit more about it while we’re here, since it’s a game changer!

Using The Profit First System To Manage Your Money

The Profit First cash management method helps you to calculate how much you can afford and how to test your finances to make sure that calculation is correct before you sign an engagement.

Using separate bank accounts to plan for your different kinds of expenses is an easy way to get a snapshot of financial clarity without a bunch of spreadsheets.

It could include separating the cost of sales from subcontractors and job supplies, general overhead expenses like marketing and rent from estimated tax savings, etc.

This concept of giving every dollar a job and every dollar a home is explained and explored in the book Profit First by Mike Michalowicz. This cash management system lets you keep your natural habit of looking at your bank balances to see that you have enough money set aside for taxes, profit, your salary, operating expenses, and any other expenses you want to easily be able to track – like adding an employee.

If you set the system up correctly, as outlined in the book, you can look at two numbers to know exactly where you stand financially: your total income, and your bank balances.

The Profit First system doesn’t replace your bookkeeper or accountant, it supplements the work that they do. Accounting records what has already happened so you can evaluate your expectations against the reality of what occurred.

A good cash management system lets you plan for the future, no matter what it may bring, and helps you always balance growth with profitability.

Back to hiring for now…

How to be really prepared for writing the job description

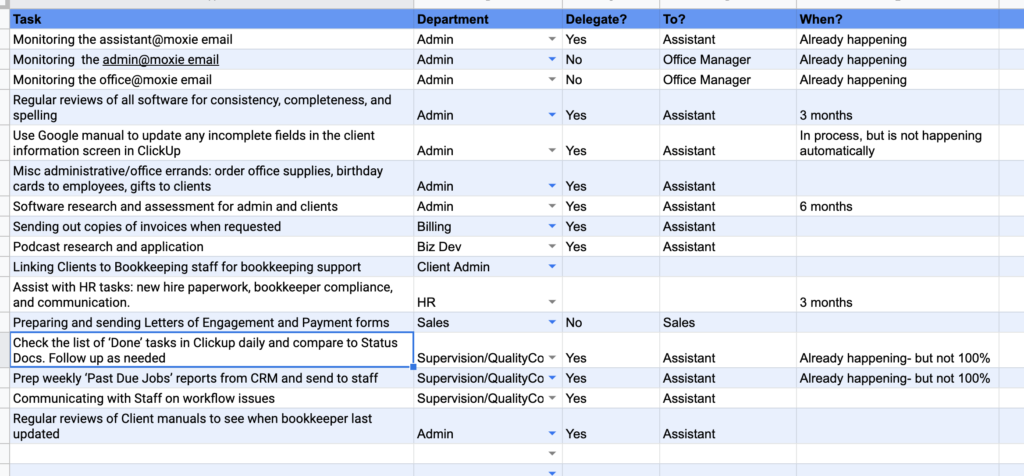

It helps to use a spreadsheet (or a piece of paper, in landscape). Make a list of all the tasks that you are currently doing in one column. Then in a separate column, label each task by what “department” it would belong to – marketing, sales, customer service, administration, or delivering services.

In a third column, write down whether or not you could delegate the task (hint: the answer should *always* be yes! If you don’t think you can delegate a task that is because you have not yet built the system to make delegation possible. That is a topic for another time).

In the fourth column, write down how soon you would like to delegate: ASAP, 1-3 months, or later. Feel free to change those time frames if they don’t feel right for you. Add a fifth column to capture any notes about any task delegations that you don’t want to lose.

Now, sort the tasks first by urgency to delegate them by department and you should get a pretty clear idea of who your first hire should be to make the biggest impact in your business and free up your time.

It can be a very simple document. Here’s what a recent one from Moxie looks like (can you tell it’s a #WIP??):

Understand the Impact Of Your Hire

Some key questions to ask yourself before you hire include:

Is that position revenue producing? It’s possible. But most likely, it’s going to be at least several months before the position starts to generate positive revenue. But don’t lose hope. Ask yourself, how many hours do you expect to free up by being able to delegate this list of tasks? Remember that it takes time to train someone so you won’t feel that relief immediately.

The more you can document in detail what you do, how often you do it, and how you do it, the easier it will be to train someone (A screen recording software like Loom can help make training even easier).

If you think you will free up 10 hours a week by delegating, how many of those hours will turn into income for you? Either by closing new business or delivering services? That will give you an estimate of the amount you can expect your top line income to increase with this additional help.

The trap to avoid, which is all too common for small businesses, is growing that top line income too quickly and in such a way that it requires a lot of growth in staffing and software support and too often businesses end up spending all – or more – of their new income on new expenses.

Thankfully it’s a trap that you won’t be falling into with the Profit First system!

Here’s where we come in

In the confusion and chaos of running a business, it’s easy to get overwhelmed and lose sight of your finances. Can you afford to hire help? Need to cut down on expenses? Are you paying yourself enough? Who knows?

The good news is that it’s fixable. You can have financial clarity 100% of the time, and always know where you stand. We’ll show you how. Hop on a free no-obligation consultation call with us and we’ll look at your unique business needs and tell you how we can help