I’ve got a different perspective on finance.

I’m not a Wall Street escapee. I didn’t come from a well-paid corporate job.

(Though if you did, of course that’s okay!)

I’ve been a freelancer, a shift worker and — later — a small business owner since the early 1990s.

I didn’t grow up with financial literacy, and like many of you I had no education in personal finance. And because of those downsides, when I started managing my own money, I ran into problems.

I had been brought up to believe if you work hard, that’s all it takes to succeed.

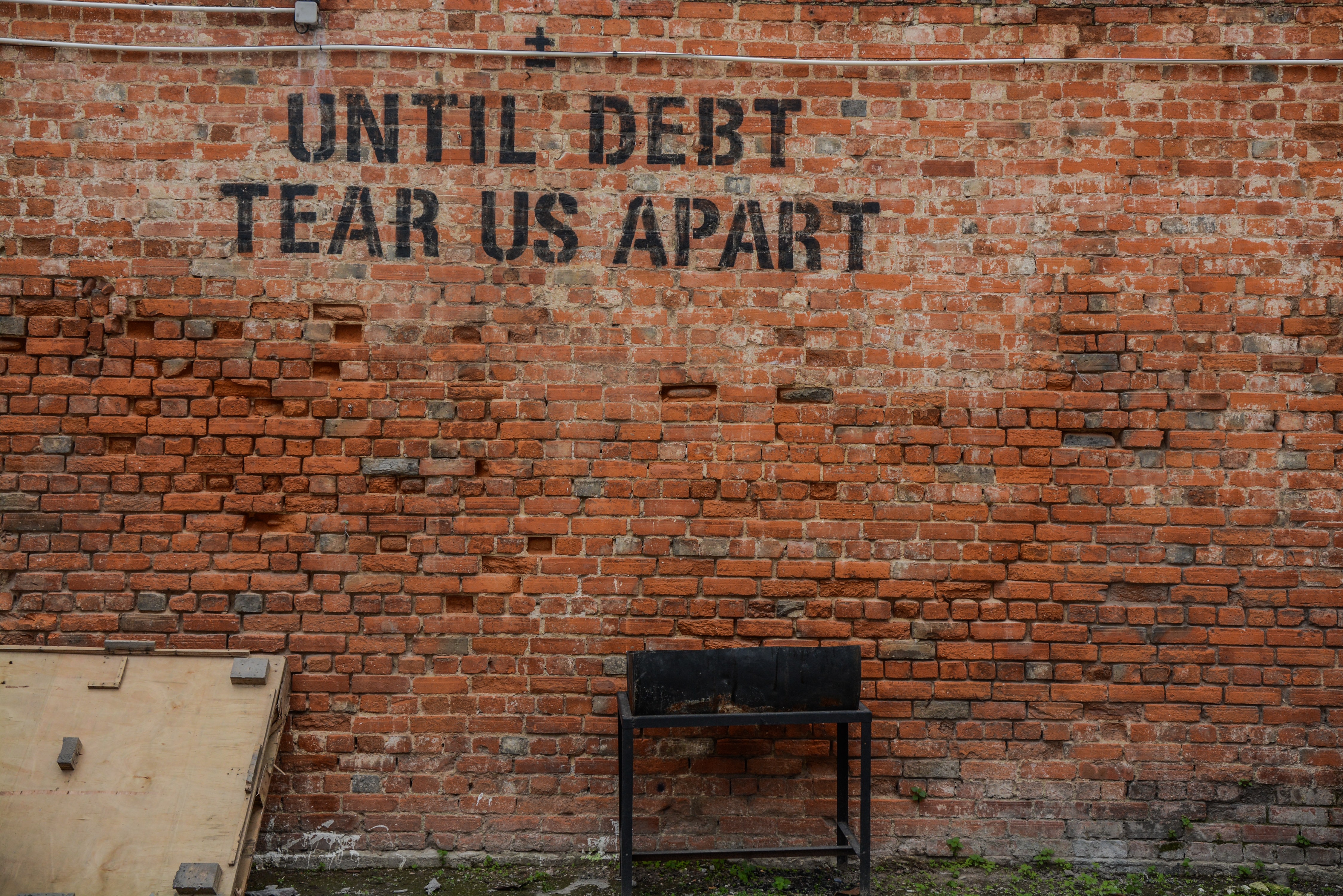

And that led to my bankruptcy.

I was tens of thousands of dollars in debt by my mid-20s, and it was mostly groceries and gas — not shoes or purses or vacations. I just wasn’t making a sustainable living wage despite multiple jobs. (I also lived in an expensive urban center.)

When I had to declare bankruptcy, I knew I had to make a change.

I started learning bookkeeping while working as a receptionist, and learned how to negotiate contracts as an office manager. I then took those skills and built on them, eventually starting Moxie.

Making it simple

Today, I bring compassion and flair to teaching the Profit First cash management system to help artists, creatives and purpose-driven entrepreneurs get at-a-glance financial clarity.

I’ve helped more than 10,000 small businesses and non-profits simplify their bookkeeping, get the most out of every dollar and be more profitable.

Let’s do the same for you.

Want financial wisdom delivered right to you?

No more checking the blog obsessively — we’re now delivering all the good stuff right to your inbox.

Sounds just like my life but I am still in the same mindset.